Zimbabwe and the One Hundred Trillion Dollar Bill

February 10, 2022

In December of 2021, the inflation rate of the US Dollar hit 7%, up from 1.4% in December of 2020. This is the highest inflation rate the country has experienced since June of 1982, during the early years of Reagan’s presidency. This number, however, pales in comparison to that of many of the world’s currencies. The Venezuelan Bolivar, 2021’s leader in inflation, had an inflation rate of 2700%. Even still, Venezuela’s gargantuan numbers do not even compare to the rate of economic decline seen by Zimbabwe in the 2000s. From 2006 to 2009, Zimbabwe experienced unprecedented sustained hyperinflation, peaking at 231,000,000% in the summer of 2008.

But what does an inflation rate of 231 million percent look like? Such rapid currency devaluation had catastrophic effects on daily life. Stores greatly increased the prices of products multiple times per day. According to CNN, one would sit down to drink a coffee at a fast-food restaurant, only to find its price has increased by the time one finished drinking it. Larger and larger bills had to be continually printed to keep up with prices. Smaller bills lost almost all their value. To try to simplify the currency and to limit the value of new bills, Zimbabwe decided to make a new currency. The Reserve Bank of Zimbabwe carried this out in August of 2006, with an exchange rate of 1000 old Zimbabwe dollars to 1 new Zimbabwe dollar, effectively cutting three zeros off of every bill.

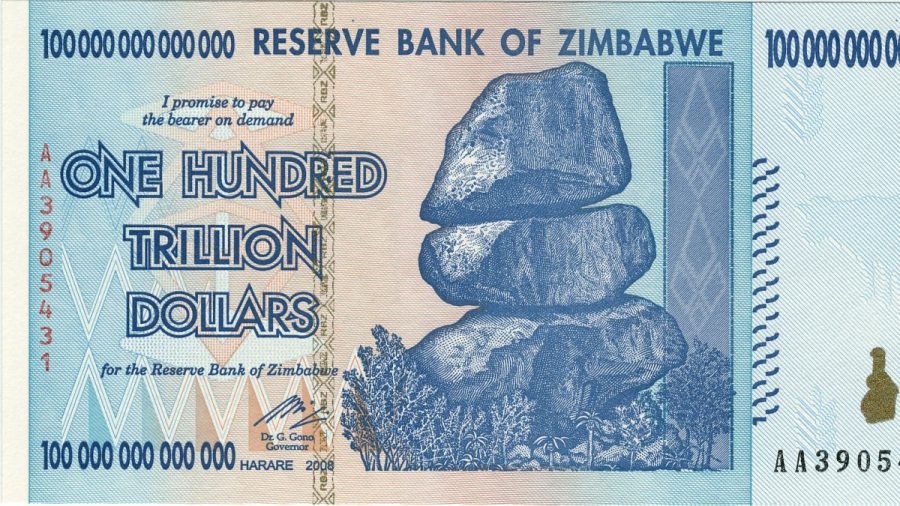

The same problems with the old currency persisted with the new one, and prices continued to rise. In July of 2008, then, Zimbabwe redenominated its currency once again, this time with an exchange rate of 10 billion to 1, cutting 10 zeros off. This, however, made no actual meaningful changes to the currency, and inflation rapidly increased. Newer, more valuable bills were continually minted and devalued; first, the Z$1,000, then the Z$1,000,000, then the Z$1,000,000,000, all reduced to a value of almost nothing. Finally, the Reserve Bank printed one final bill, with the largest number ever printed onto a banknote: the 100,000,000,000,000 dollar bill, worth 1027 original Zimbabwe Dollars. This banknote, which was first minted in late 2008, was short-lived, as Zimbabwe redenominated for a third time in February of the next year, cutting a further 12 zeros off the current banknotes, making this new Fourth Zimbabwe Dollar worth 1025 original dollars from only three years prior.

What, then, did Zimbabwe try to solve its inflation problem? Very little. Instead of trying to restore faith in its economy and government, Zimbabwe decided to just ignore the problem and keep printing more and more money, which accelerated inflation further. In the end, Zimbabwe decided that the best way to deal with its inflation problem was not to deal with it at all; on September 13, 2008, the country legalized the use of foreign currencies within its borders, accepting it as legal tender the next January, and, in April of 2009, Zimbabwe ceased printing its own money. For the next decade, the country’s economy would be dominated exclusively by foreign money, namely the US Dollar and the South African Rand, until it began producing its own currency again in 2019.